Forex trading is almost always risky. But investing in online Forex trading can be even riskier if done through an unreliable broker, the kinds that have mushroomed over the internet in the past couple of years. However, by choosing a secure and reliable broker, you can ensure the safety of your hard-earned money. To assist you in making a wise decision, we have created a list of the top legal and certified Forex brokers in Pakistan. Review the list to make an informed choice for your online Forex trading.

| Broker Name | Min. Deposit | Trading Platforms | Deposit Methods | Bonus | Min. Spread | Max Leverage | Regulated By | Open Account |

|---|---|---|---|---|---|---|---|---|

|

10 $ | MT4, MT5, XM WebTrader | Visa, Master Card, Union Pay, Nettler, Skrill, Cash U, Bitcoin, Bank Transfer | $30 bonus | 0.6 pips | 1:500 | CySEC, IFSC, FCA, DFSA Dubai, Asic | Open |

|

100 $ | MT4 | Visa, Master Card | No Bonus | 0 pips | 1:100 | Department of Economic Development Abu Dhabi, and the Securities and Commodities Authority (SCA). | Open |

|

100 $ | MT4, MT5, Web Trader | VISA, Mater Card, Pal Pal Skrill almost all kind of Payment solutions | 0 | 0 | 1:300 | FSA | Open |

The foreign exchange market, also known as Forex, is one of the

largest markets in the world, trading trillions of dollars daily,

around the clock. Due to its low cost of doing business, it

appeals to both small and large traders alike.

It involves the exchange of one country’s currency for another’s,

for reasons such as tourism, commerce, or other reasons. As global

business continues to expand, the need for transactions in

different currencies will also increase.

Forex markets provide a way to hedge against currency value

fluctuations by fixing a rate for future transactions. Investors

can also buy or sell one currency against another, with the hope

of profiting from changes in currency strength.

The benefits of Forex trading include ease of entry and exit, the

ability to use leverage to control large positions with less

money, and the market being open 24/7.

To be successful, traders should view Forex trading as a way to

diversify and use charts to time their trades, and avoid impulsive

behavior with common sense.

Forex trading in Pakistan is relatively unrestricted, with the

exception of buying and selling cryptocurrencies, which is

currently prohibited. However, due to the lack of registration of

many local brokers with the Securities and Exchange Commission of

Pakistan (SECP), there is a high risk of fraud and money

laundering.

Therefore, it is highly recommended that traders open an account

with a forex broker based outside of Pakistan. It is legal for

international brokers to offer accounts to Pakistani traders, but

not all brokers choose to do so. When opening an account with an

international forex broker, the process typically involves the

following steps:

Get a stable internet connection:

Before beginning to trade forex, it is essential to have a stable

internet connection. A consistent internet connection is a

critical requirement for successful forex trading, so make sure

you have one established before proceeding.

Pick a reliable broker:

Selecting a broker is an important step for forex traders in

Pakistan. Many traders choose to open an account with an

international broker as they are more strictly regulated,

particularly those in countries such as Australia, the United

Kingdom, and the United States. Carefully evaluate the options and

apply to open an account with the chosen broker.

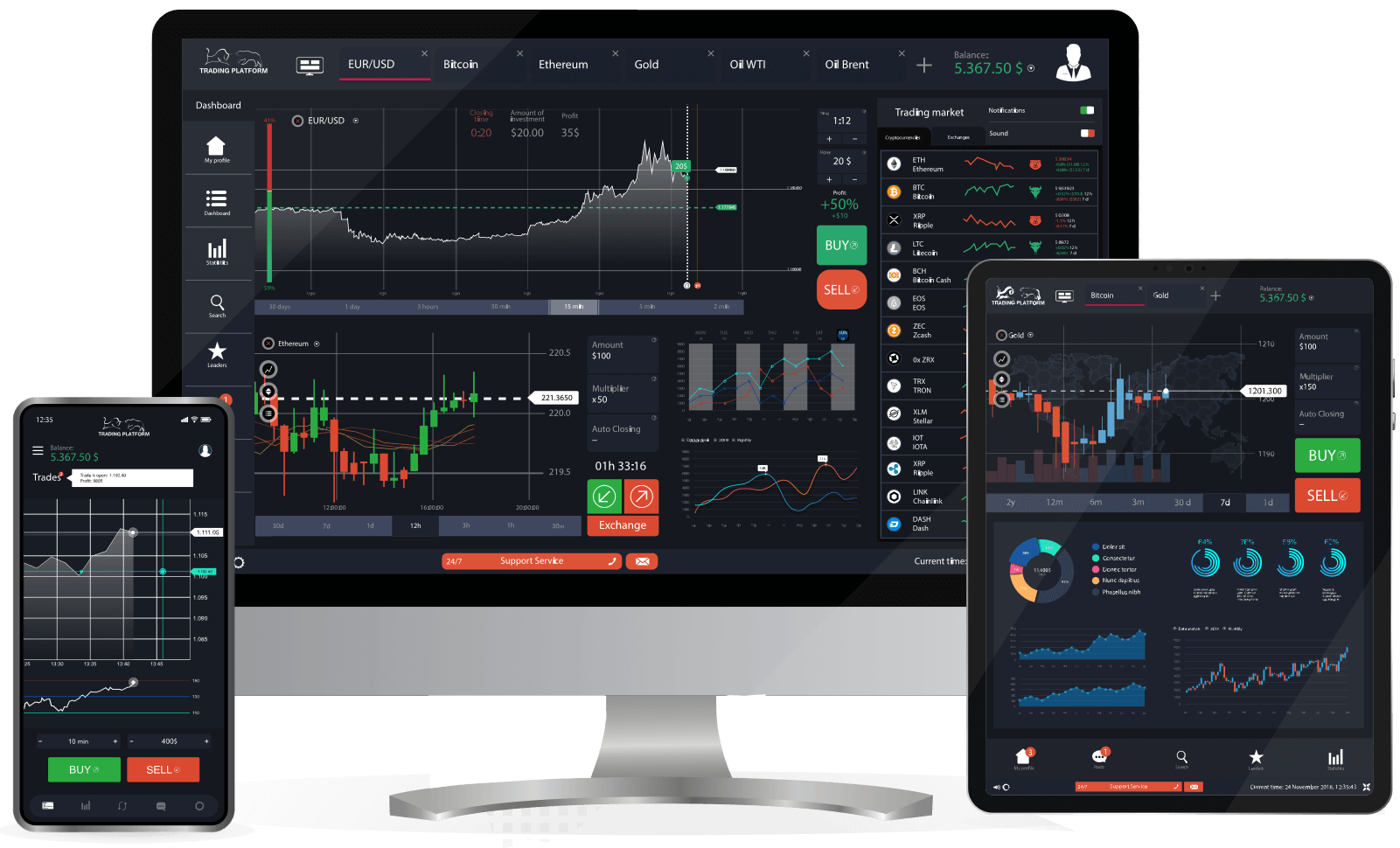

Choose a forex trading platform:

Choosing a trading platform is an important step in forex trading.

While some brokers provide their own platform, you may also want

to consider more comprehensive options.

Link a bank account: To start trading, you’ll need to fund your

account. After opening your trading account and having your

personal information approved by the broker, you can fund your

account by linking a bank account and converting your local

currency to a more commonly traded currency such as USD or GBP.

This is typically allowed by most international brokers for

Pakistani traders.

Start trading:

After funding your account, you can officially begin trading by

making your first currency trade.

Yes, Forex Trading is legal in Pakistan and locals are becoming

more and more interested in it as the country’s economy improves.

As one of the Next Eleven developing countries, Pakistan is

expected to grow to be a significant economic force in the

twenty-first century.

Contrary to popular belief, it is legal to trade forex while

residing in Pakistan. A rising number of Pakistani traders are

turning to the forex market because of its virtually endless

potential as the country’s economy grows and transforms.

In fact, the trade of currencies is essentially unrestricted in

Pakistan. Many local brokers are not registered with the

Securities and Exchange Commission of Pakistan (SECP), despite the

SECP’s efforts to curb money laundering.

Therefore, it is strongly advised to register an account with a

currency broker outside of Pakistan. Although it is legal for

foreign brokers to provide accounts to traders in Pakistan, not

all companies choose to do so.

To open an account with a forex broker, you will need to provide

personal information such as your name, contact information, date

of birth, social security number or tax ID, citizenship,

employment status, account currency, and password.

You may also be asked about your income, net worth, and trading

experience and goals. After the account is created, you can begin

trading with the broker.